Responsible researcher: Angelo Cruz do Nascimento Varella

Article title: IMPACT OF MONETARY POLICY SHOCKS ON THE SUPPLY OF REGIONAL CREDIT: AN ECONOMETRIC ANALYSIS USING THE VAR METHODOLOGY FOR BRAZIL IN THE 2000s

Authors of the article: Leonardo Dondoni Dutra, Carmem Aparecida do Valle Feijó and Julio Cesar Albuquerque Bastos

Location of intervention: Brazil

Sample size: Municipal banking statistics from 2003 to 2012

Sector: Finance

Type of Intervention: Effects of bank concentration and national credit supply

Variable of Main Interest: Regional credit supply

Assessment method: Others

Policy Problem

Monetary policy is of great importance for a country's economy, since it is through this system that the government controls the amount of currency in circulation, using tools, such as the basic interest rate (SELIC), and indicators, such as the that measure inflation. However, these public policies have natural limitations to the financial system, so that the measures taken cannot always achieve the desired objectives. This is the case, for example, of the availability and ease of access to credit, which is an indicator that has an impact directly in national economic development. One of the problems affecting the supply of credit in Brazil is identified by researchers as a consequence of the way in which the banking system is established in the country, with a concentration of services in the richest and most populous locations.

This difference between regions is a relevant topic, as the supply of credit can influence the generation of income and employment, the amount of investment and local production, which are fundamental factors in the economic development of a region.

Assessment Context

In Brazil, one of the ways to implement public monetary policies is determined by the Monetary Policy Committee (COPOM), of the Central Bank (BACEN), which works to define the SELIC in meetings that take place every 45 days. These meetings define the most basic interest rate in the economy, which influences all other interest rates applied in the country.

Thus, when the SELIC decreases, getting money through loans and financing becomes easier and the economy becomes more liquid and heated, that is, there is more money circulating. On the other hand, if the SELIC becomes higher, interest rates become more expensive and the economy tends to cool down. Obviously, the banking sector has great influence on this system.

It is through banks that access to credit occurs, so that, effectively, the correction of the SELIC rate goes through these institutions of the financial system. However, in Brazil, the concentration of the banking system in populous regions with more consolidated economies generates inefficiency in granting credit, which creates a barrier to access to credit in poorer regions that negatively impacts local economic development.

Policy Details

Theoretically, the government's intention is to influence the economy as a whole, in a homogeneous way, so that monetary policy affects all regions in the same way. However, in the Brazilian case, banking concentration changes the impacts of this public policy in places where there are fewer people and resources. As a consequence, regions that are already economically disadvantaged suffer even more.

This phenomenon also occurs due to two very important factors in economic sciences: uncertainty and liquidity. Uncertainty affects the supply of credit because it turns the act of investing into a more dangerous activity. In other words, in uncertain scenarios, banks will prefer to invest in safer options, in order to avoid losses. Furthermore, in these circumstances, banks will prefer more liquid options, which means that these institutions will choose to invest in assets that can turn into cash more quickly.

These variables are investigated by the researchers, together with data on the volume of credit actually granted in Brazil, with the intention of investigating whether the behavior of banks is different in different Brazilian regions, faced with a situation in which the interest rate increases.

Methodology Details

Using the Municipal Banking Statistics (ESTBAN) database from the Central Bank of Brazil (Bacen), researchers analyze monthly information on the Brazilian granting of municipal credit, between the period from January 2003 to December 2012. From this base data, two mathematical models are conducted, with the intention of measuring the reaction of the national banking system, based on a monetary policy of increasing the SELIC, the basic interest rate.

The econometric model used for both calculations is vector autoregressive (VAR), which is essentially a mathematical formula used to analyze time series, that is, standardized data sets that vary over time. With this model it is possible to determine whether there was a change in banks' behavior following the increase in interest rates.

Firstly, the authors assess whether the positive impact on interest rates affects the preference for bank liquidity and the provision of doubtful credits, as a measure of uncertainty. The lower the preference for liquidity and the greater the amount of credit granted, the more banks are contributing to the heating of the regional economy. Second, the authors measure the amount of short-term credit provided and credit intended for production and agriculture. Thus, in addition to measuring the impact on liquidity preference and the treatment of uncertainty, the real impact that monetary policy had on the different regional banking systems is also analyzed.

Results

In the following graphs it is possible to observe the results of the analyzes for the preference for liquidity (upper block) and the provision of credit with a greater degree of uncertainty (lower block). In all regions, it is possible to observe that higher interest rates generate less preference for liquidity. This occurs because the higher interest rate gives banks incentives to lend to earn more. It is worth highlighting, however, that the Southeast region, as it accounts for almost 70% of the total national credit supply, stabilizes more quickly, returning to levels prior to the increase in interest rates after ten months. In other regions, this normalization happens in twice the time. A similar behavior occurs in relation to the uncertainty measure, in which the Southeast region presents the shortest adjustment period, just seven months after the positive interest rate shock.

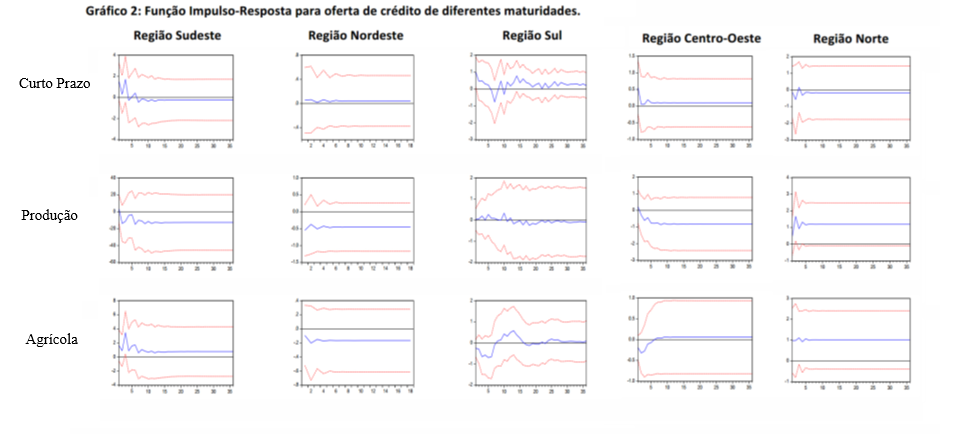

In relation to the volume of regional credit granted, it is possible to observe that the Southeast region has the most robust banking system prepared to deal efficiently with variations in monetary policy, in all the modalities analyzed. In other regions, it is possible to observe that short-term credit options have a strong tendency, even in circumstances of rising interest rates, so that banks use such mechanisms in these locations to increase their profitability, so that other credit offers vary from region to region.

Public Policy Lessons

Ensuring the efficiency of the banking sector is essential for the success of an economy. Specifically in the Brazilian case, this efficiency is reduced by the different characteristics that each region has. The Southeast region, for example, in addition to concentrating a large part of the national wealth and population, also has the largest and most robust banking system in the country.

As a consequence, the concentration of banking services constitutes a serious obstacle to regional economic development. Adequate access to credit is a determining factor in financial balance and the effective implementation of public policies, such as monetary policy. It is necessary for public authorities to act to mitigate such differences, reducing existing incentives for financial institutions to harm regions with less economic development, aiming to improve not only the national economic system, but also the efficiency of Brazilian monetary policy.

Reference

DUTRA, Leonardo Dondoni; DO VALLE FEIJÓ, Carmem Aparecida; BASTOS, Julio Cesar Albuquerque. Impact of monetary policy shocks on regional credit supply: An econometric analysis using the VAR methodology for Brazil in the 2000s. Brazilian Keynesian Review, v. 3, no. 1, p. 48-74, 2017.