Responsible researcher: Eduarda Miller Figueiredo

Original title: The Production Relocation and Price Effects of US Trade Policy: The Case of Washing Machines

Authors: Aaron Flaaen, Ali Hortaçsu and Felix Tintelnot

Intervention Location: United States

Sample Size: -

Sector: Public Sector

Variable of Main Interest: logarithm of the price

Type of Intervention: Tariff changes ( antidumping )

Methodology: OLS

Summary

In 2018, the United States imposed a series of tariffs on various products – largely sourced from China – using a variety of trade policy measures. The article studied here focused on studying a final consumer good – washing machines – and provides evidence of the effects of trade policies on trade flows, domestic production and, most notably, prices. Using data for the United States, the authors find that retail prices increased only modestly after antidumping and import prices decreased even after antidumping .

Trade policy came to the forefront of economic policy debates in the United States in 2018. In 2018, the United States imposed a series of tariffs on various products – largely sourced from China – using a variety of trade policy measures. One of the several issues of these policies is the incidence of tariffs, that is, whether the value of import taxes is passed on to consumers in the form of higher prices or absorbed by foreign producers, reducing their export price.

The article studied here focused on studying a final consumer good – washing machines – and provides evidence of the effects of trade policies on trade flows, domestic production and, most notably, prices. With the available data, the authors calculated the tariff elasticity of consumer prices, which measures price variations covering the global set of goods available to consumers (imported and domestically produced) in relation to the average variation in the tax applied to these goods through of import tariffs.

The literature already has some evidence on the response of multinational companies to tariff changes. Horstmann and Markusen (1992) show that in response to an import tariff, a foreign multinational may establish a factory in the home country, which could lead to lower domestic prices than without the tariff. Blonigen (2002) studies the tariff jumping behavior of foreign companies in relation to antidumping in the 1980s, finding an economically small increase in the probability of a foreign company establishing production in the US in response to antidumping [1] .

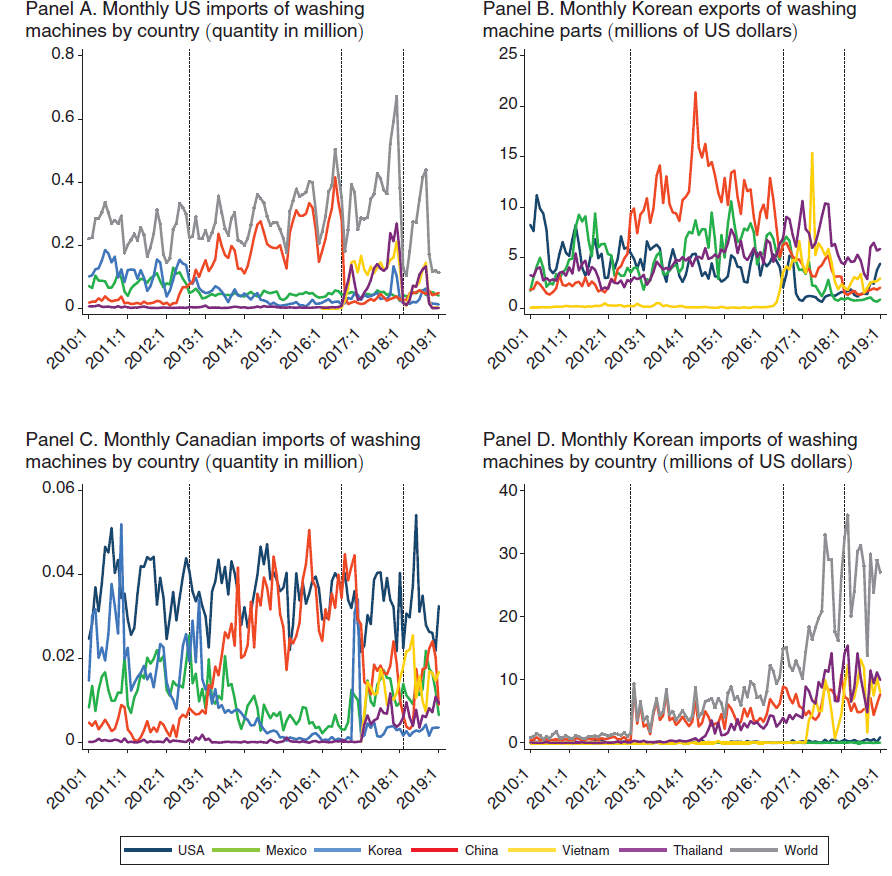

The first round of trade policy measures against imported washing machines consisted of country-specific anti-dumping antidumping duties were initially imposed on Mexico and South Korea in 2012, in 2016 they were applied in China. The second round of measures enacted “safe guard” tariffs [2] in practically all countries of origin for imports of washing machines to the United States. As a result, companies transferred production following each new trade policy: first from South Korea/Mexico to China, then to Thailand/Vietnam and, finally, to the United States, avoiding paying import tariffs.

With changes in production and trade flows, significant price movements occurred. In the 12 months after the application of anti-dumping in South Korea and Mexico, the washing machine consumer price index (CPI) decreased by about 5%; after the application in China, the CPI maintained its trend. However, the CPI increased in the months following the “safe guard” tariffs, rising around 9% until February 2019.

The third round of tariffs imposed on Chinese imports occurred in September 2018, including refrigerators and electric and gas stoves.

To more fully assess the price impacts of these tariffs, the authors used detailed weekly data on retail prices for major household appliances. Their concern in comparing washing machine prices before and after changes in trade policy was the presence of other shocks that changed the price of washing machines independently of the trade policy under study. Therefore, other household appliances were used as control products for the variation in washing machine prices.

As demonstrated in panel A of Figure 1, imports increased in late 2017 and early 2018 as producers rushed to ship washing machines to the United States before tariffs took effect. Subsequently, imports fell sharply in February and March 2018. In addition to supply chain effects, US policy also had notable implications for third-country trade flows. Panels C and D of Figure 1 show how Canadian and Korean consumers were affected by trade policy.

Figure 1: Commercial Flows of Washing Machines and Washing Machine Parts

Sources: US International Trade Commission; Korea Customs Service. Canadian International Merchandise Trade Database .

For the study, the authors used data from Gap Intelligence (2013-2018), a market research company that collects data from a wide range of products and markets in the US. The raw data set contains weekly inputs of price data and product characteristics at the retail model level, from March 2013 to December 2018. In addition to the published retail price, data on brand, model, release date and several other features of the product.

To estimate the effect on the price of antidumping against China (July/2016) and “safe guard” tariffs (February/2018), a regression was carried out where the dependent variable is the logarithm of the price and the explanatory variables include the product characteristics and retailer and year-week fixed effects, in addition to an interaction for each category with weekly fixed effects.

Baseline estimates suggest a price increase of just 1.5 to 3.5 percent for washers and dryers over 4- to 8-month periods. Estimates using model fixed effects show slightly higher coefficients; although price estimates for the two placebo devices suggest that not all of this increase was due to tariffs. In contrast, the estimated price effects of “safeguard” tariffs are more impressive. The results suggest that the price of washing machines increases by around 11% in the 4 to 8 months after these tariffs are applied. And in this case, the estimates relative to the alternative specification – with the fixed effects – remain essentially unchanged.

The authors also calculated sales rank correlations for washers and dryers for the top brands they studied, as they are typically sold together. The data provided clear evidence of complementarities between washers and dryers[3].

The evidence demonstrates that, as a whole, washers and dryers experienced notable price increases following the 2018 “safeguard” tariffs. Multiplying these estimates by the pre-increase average price of washers ($749 per unit) and dryers ( US$ 809 per unit), it turns out that the increase in the price in dollars attributable to these tariffs was 86 dollars per unit for washers and 92 dollars per unit for dryers.

With the tariffs under consideration not applied uniformly across all models, these estimates could mask much larger price changes on the part of foreign producers, with little or no price change on the part of domestic products. To explore this heterogeneity, the authors repeated the regressions, but allowing separate coefficients for each brand. Estimates show that all major brands have increased prices following the “safe guard” tariffs. There is no clear distinction between domestic and foreign brands, all within a range of 5% to 17%.

Regarding the tariff elasticity of consumer prices, the results suggest a wide range of elasticity of consumer tariffs. The estimate suggests for the antidumping against South Korea and Mexico indicates a decline in prices and therefore a negative elasticity. The results demonstrated markedly different effects on consumer prices between single-country and multi-country tariffs. The authors also highlight that price increases by national competitors and complementary goods can increase this elasticity well above one.

Offshoring of production plays an important role in extending the transmission of tariffs to prices. Retail prices increased only modestly after anti-dumping imposed in China in 2016 and import prices declined even after the anti-dumping in South Korea and Mexico.

National producers increase prices following the “safe guard” tariff by a margin similar to that of importers. Price increases by national brands are consistent with an oligopoly model, in which prices are completely strategic.

References

Blonigen, Bruce A. 2002. “Tariff-Jumping Antidumping Duties.” Journal of International Economics 57 (1): 31–49.

Holden, P. A dictionary of international trade organizations and agreements . Routledge, 2011.

Horstmann, Inácio J. and James R. Markusen. 1992. “Endogenous Market Structures in International Trade (Natura Facit Saltum).” Journal of International Economics 32 (1): 109–29.

[1] Antidumping practices : “trade defense mechanisms, employed by countries that accuse foreign companies of predatory prices, are regulated by the WTO” (Holden, 2011).

[2] “Safeguard” Tariffs: is a temporary import restriction that a country can impose on a product if imports of that product increase in such a way as to cause, or threaten to cause, serious injury to a national industry that produces a similar product or directly competitor. ( International Trade Administriation, https://www.trade.gov/trade-guide-wto-safeguards )

[3] The correlation of sales rankings for a brand's washers and dryers at a given retailer is quite high, 0.9 to 0.95, and typically lower, 0.3 to 0.9, for other appliance pairs.