Responsible researcher: Eduarda Miller de Figueiredo

Authors: François Gerard and Joana Naritomi

Intervention Location: São Paulo

Sample Size: 77,892 layoff events

Sector: Job Market

Variable of Main Interest: Consumer spending

Type of Intervention: Dismissal

Methodology: Differences-in-Differences

Summary

After dismissal, workers are impacted by a negative and permanent shock to their income. However, at the same time there is a positive transitory income shock with severance pay or unemployment insurance. The article set out to observe a context in which the incentives to smooth consumption are particularly strong. Using data for São Paulo and applying the Differences-in-Differences model, changes in consumer spending for displaced workers in the 12 months before and after dismissal are estimated. Estimations suggest that all groups of workers experienced a sharp and significant increase in expenses after layoff.

The literature documents a high sensitivity of consumption to positive transitory income shocks (Shapiro, 2005; Olafsson and Pagel, 2018). Termination security values show higher consumption levels in the first months after dismissal. In other words, displaced workers tend to have limitations in financial resources, however, displaced workers can smooth consumption well beyond unemployment insurance if they save layoff money more slowly (Chetty, 2008; Ganong and Noel, 2019).

In this article, the authors observe a context in which incentives to smooth consumption are particularly strong. Examining the spending behavior of individuals who receive a one-time severance payment, i.e. a transitory income shock, at the same time as they are laid off and therefore experience a permanently negative income shock. Standard economic models with forward-looking agents typically predict that a large part of this lump sum must be saved to smooth consumption losses arising from the permanent negative shock.

The empirical analysis was developed in the state of São Paulo, the largest state in Brazil, which has a population of 42 million inhabitants and is responsible for 34% of the country's GDP. Informal workers in the state of São Paulo represent around 35% of employment in the private sector, and are therefore not covered by work displacement insurance programs.

In Brazil, there are three sources of job displacement insurance benefits for those workers who are involuntarily laid off from formal jobs in the private sector.

To carry out the analysis, a combination of administrative data sets was used. Through RAIS, formal worker identification data was collected, as well as information on age, race, sex, education, sector, hours, among others. SD records captured data including the worker ID, date and benefit amount for all payments. With the Nota Fiscal Paulista (NFP) program, the authors were able to combine formal employment and UI data with administrative expenditure data.

With this, all full-time formal private sector employees in São Paulo who were laid off between 2011 and 2013 were selected. Obtaining expense and employment data from at least one year before and one after the layoff for all workers with expense data. A sample of 77,892 layoff events and a reference sample of 156,11 layoff events were obtained by randomly selecting 5% of the general RAIS sample.

We used a Differences-in-Differences model to estimate changes in consumer spending for displaced workers in the 12 months before and after layoff, compared to a control group of workers employed for the entire 25-month period. The control group was constructed by creating worker-month pairs for “placebo” commuting events in the months between 2011 and 2013. The control group contains 220,160 commuting events.

The dependent variable is consumer spending for displaced workers in the months surrounding the layoff compared to a reference month. Furthermore, fixed effects of each event (dismissal) of the worker were added and the standard errors were grouped by worker.

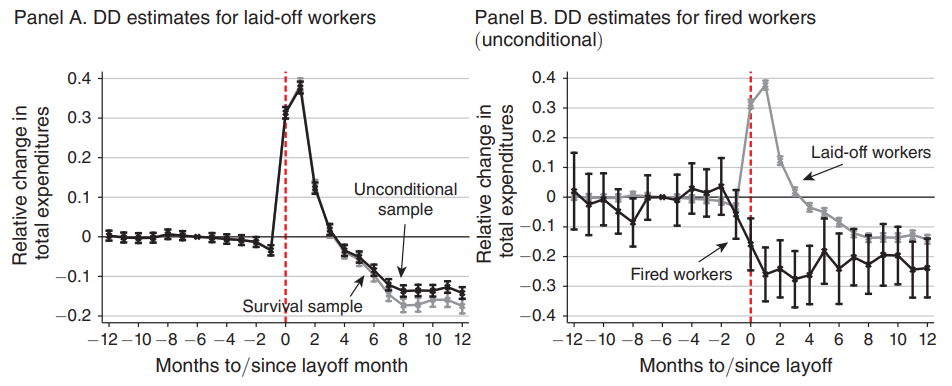

The results show that total expenses increase by 31.4% and 37.7% in the month of dismissal and the subsequent month, respectively. The estimates decrease rapidly but remain positive in months 2 and 3 after dismissal, as shown in Panel A of Figure 1.

Figure 1: Expense profile around commuting

In months 4 and 5 the estimates are negative and more stable, and in months 6 and 8 there is again a faster decrease, which is exactly in the months that workers exhaust their unemployment insurance benefits.

Panel B of Figure 1 compares Differences-in-Differences results for laid-off workers versus workers who were fired for cause and therefore not eligible for UI. Estimates after displacement (period 0) demonstrate that workers fired for cause experience a drop in consumer spending, which reaches 26% in month 1. The large difference in spending profiles indicates that the benefits of UI in job displacement can deal with spending patterns in unfair dismissal. Estimates for laid-off workers remain low in the following months and below estimates for workers laid off without cause, although the proportion of reemployed workers is higher among those laid off for cause than those laid off, which is consistent with SD's disincentives to search. of jobs.

Furthermore, estimates show that all groups of workers experienced a sharp and significant increase in expenses after layoff. The authors even found the same increase in spending for immediately reemployed workers, providing support for the argument that the increase in spending on layoff is unlikely due to a complementarity between leisure and expenses. It was also noted that immediately reemployed workers are the only group that did not experience a long-term loss and that expense levels increase in the month following reemployment. Thus, there was an increase in expenses of around 5% for workers reemployed in months 0 to 10 and around 10% for those reemployed after the end of SD.

However, the authors point out that unemployment insurance benefits require workers to remain without jobs, which would lead to minor distortions in job search efforts, as also discussed in Feldstein and Altman (2007).

The results found in the article demonstrate that installment payments of unemployment insurance can be important, compared to severance pay paid in one go, to smooth post-resignation consumption. If the objective of a program is to provide insurance to displaced workers, the results imply that a lump sum disbursement (severance pay) could undermine that objective.

References

GERARD, François; NARITOMI, Joana. Job displacement insurance and (the lack of) consumption-smoothing. American Economic Review , vol. 111, no. 3, p. 899-942, 2021.