Responsible researcher: Angelo Cruz do Nascimento Varella

Article title: IMPACTS OF AN ENVIRONMENTAL TAX ON DEMAND IN BRAZILIAN AIR TRANSPORT

Authors of the article: Carolina Barbosa Resende and Alessandro Vinícius Marques de Oliveira

Location of intervention: Brazil

Sample size: Data on the airline sector between 2002 and 2013

Sector: Environment, Energy & Climate Change

Type of Intervention: Effects of creating an environmental tax for the airline sector

Variable of Main Interest: Demand for airline tickets

Assessment method: Others

Policy Problem

The emission of greenhouse gases is a global problem, as it generates the greenhouse effect, which increases the planet's temperature and triggers a series of environmental imbalances. Consequently, in recent decades, global warming has become an important public policy agenda in practically all sectors of developed and developing economies.

Consequently, the airline sector, which also contributes to global warming, is covered by measures to reduce greenhouse gas emissions. However, it is important to highlight and take into account the importance of air transport for economic development, especially in the case of developing countries.

Context Assessment

Since the 1990s, several countries around the world have been negotiating measures to control global warming and its harmful consequences. This is the case, for example, of the Kyoto Protocol and the implementation of measures to reduce greenhouse gas emissions, led by the United Nations.

Since one of the main causes of emission of these gases is the burning of fossil fuels, aviation also contributes to global warming, so that, in general, 70% of emissions from aviation are carbon dioxide, one of the main pollutants. which causes the effect of increasing the temperature of the planet.

Therefore, one way to reduce the emission of greenhouse gases in aviation is to curb consumption, through a public policy of environmental taxation. This measure, studied in Europe, not only reduces air travel but also generates revenue to combat the negative consequences of pollution in the airline sector. However, it is important to highlight that this measure also negatively impacts the economic development of the region affected by environmental taxes.

Policy Details

Environmental taxation is an easy-to-understand concept. By allocating a tax on airline ticket prices, the economic incentive to travel is reduced and, as a consequence, emissions of polluting gases are also reduced. Furthermore, the revenue from the application of the tax generates revenue that the government can use to reduce damage and encourage the development of new technologies, which will be more efficient from an environmental point of view.

There are, however, negative economic and social consequences to be considered. Not only will there be an increase in costs associated with air tickets following the implementation of the new environmental tax, but there will also be a decline in demand, which means that fewer people will be able to travel by plane, impacting businesses and citizens and other economic sectors , such as tourism and other means of transport.

This relationship between environmental benefits and economic costs from the application of a taxation system in the Brazilian air transport sector is the central theme of this work, carried out by researchers from the Instituto Tecnológico de Aeronáutica – ITA.

Methodology Details

Using information collected from the National Civil Aviation Agency (ANAC), the Brazilian Institute of Geography and Statistics (IBGE) and the IPEA Data database, from the Institute for Applied Economic Research (IPEA), the researchers created a database with referring to 12 years of activities in the Brazilian air transport sector, in the period between January 2002 and December 2013.

For the purposes of the research, two mathematical models were developed. The first of them uses the data obtained to measure characteristics of the air transport market, based on an econometric model called multiple linear regression. The second model incorporates the results of the first calculation to carry out a simulation of the implementation of an environmental tax in the airline sector, estimating the behavior of economic agents in this hypothetical scenario.

In this way, it is possible to consider the historical behavior of consumers and companies in the airline sector when simulating the application of an environmental tax system, estimating the economic, social and environmental impacts of implementing this new public policy in Brazil.

Results

The results found are interesting and, in general, agree with other similar studies carried out in other countries. Essentially, as expected, an environmental tax applied to the air transport sector has a negative impact on the demand for air travel, so that demand is reduced due to the increase in prices.

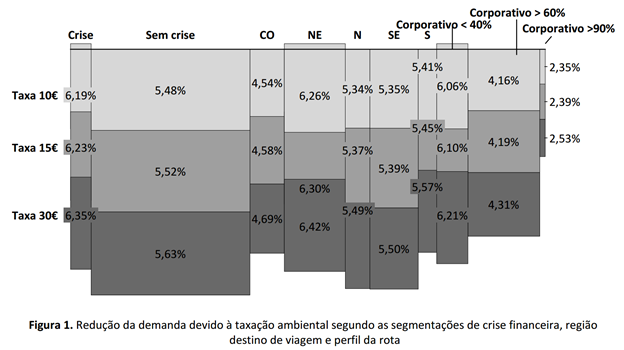

The authors estimated different rates in different sectors and regions. All fees applied, in the amounts of 10, 15 and 30 euros, had a negative impact on demand. The main region affected is the Northeast, due to its airline sector being heavily influenced by tourism, whose demand suffers most from the increase in prices. In other words, the economic and social cost was greater for this region.

Two other important results refer to corporate demand and periods of crisis. In short, periods of crisis, as is the case in Brazil since 2008, present worse results in terms of demand for air tickets. Furthermore, corporate demand, that is, the purchase of tickets by companies tends to be less impacted by the increase in prices, which indicates that the environmental tax affects companies' profits and people's decisions.

The following graph presents the results of the simulations. The width of the columns is proportional to the sample size. The first two columns demonstrate the analyzes with and without crisis, as well as the following five columns refer to the regional analyses. The percentages called “Corporate”, in the last three columns, represent the impact on demand according to the proportion of corporate tickets.

Public Policy Lessons

Studying and measuring the impact of applying a new public policy is essential to ensure its desired effects. Without this research, implementing a new rule could result in unintended consequences that make the situation worse. In the case of the airline sector, for example, in addition to having a negative impact on the economy and society, it is possible for individuals to migrate to other sectors that are also polluting, such as road transport, generating other negative externalities. However, it is also necessary to consider the negative impact of not adopting adequate environmental protection measures. The challenge lies in this sensitive balance.

Thus, in the present work, researchers present a model with the intention of demonstrating the economic and social impacts of implementing an environmental tax in the Brazilian airline sector, arguing that aviation has a direct impact on companies, society and other sectors of the national economy. .

Reference

RESENDE, Carolina Barbosa; DE OLIVEIRA, Alessandro Vinícius Marques. Impacts of an environmental tax on demand in Brazilian air transport. Transport, vol. 25, no. 2, p. 78-90, 2017.