Responsible researcher: Eduarda Miller de Figueiredo

Article title: THE INFLUENCE OF REELECTION ON SUBNATIONAL FISCAL POLICIES

Article authors: Fernanda L. Marciniuk and Mauricio S. Bugarin

Location of intervention : Brazil

Sample size : 5,568 municipalities.

Sector : Others

Type of intervention : Effects of re-election

Variable of main interest : Fiscal indicators and the coefficients of the variables that identify mayors expecting re-election and those without expectation of re-election

Assessment method : Panel Data and Differences in Differences

Policy Problem

The literature calls the “ Incumbent Effect” the candidate who already holds the position of mayor and is running for re-election, thus contesting the elections in a more favorable condition than his competitors. Since in addition to already having greater political visibility, it also has the administrative structure of public resources at its disposal (Ferejohn, 1977; Uppa, 2008). From this, mayors use these privileges for self-promotion and, thus, re-election would generate an irresponsible increase in spending in municipalities with mayors running for re-election (Brambor and Ceneviva, 2012).

The so-called “ Political Business Cycle ” or “ Political-Budget Cycle ”, also evidenced in the literature, is an incentive that motivates incumbent politicians to intensify their spending in the periods close to the election with the aim of increasing the probability of re-election (Nordhaus, 1975 ; Sakurai and Menezes-Filho, 2011).

On the other hand, re-election also serves as a mechanism for controlling and punishing the bad ruler (Nery, 2013). Since the single mandate limits the capacity to carry out public services and works, encouraging the discontinuity of public administration. In other words, theoretical arguments that define reelection as a mechanism that generates transparency and democratic control.

Assessment Context

In Brazil, evidence shows that there is an increase in current expenditures and total expenditures in municipalities in election years and that greater expenditures would increase the probability of re-election or election of a supporter at the municipal level (Sakurai and Menezes-Filho, 2008 and 2011). Furthermore, Ferraz and Finan (2010) demonstrate that mayors who expect to remain in office for another term will, on average, be less corrupt than mayors without incentives for re-election.

Meneguin and Bugarin (2001) build a dynamic model that measures the effect of reelection on Brazilian subnational government spending decisions. Demonstrating that there is a reduction in the marginal benefit of the deficit in the first term when reelection is certain. In which, the greater the probability of re-election, the less willingness to have expenses greater than revenue, given that the governor himself will have to bear the deficits in the subsequent term.

Policy Details

The Fiscal Responsibility Law (LRF) establishes public finance standards that aim at responsible fiscal management. Requiring the public manager to observe limits, conditions and parameters in revenue and expenditure, preventing the occurrence of successive deficits in government accounts. Thus, the LRF sets a prudential limit of 57% and a ceiling limit of 60% of net current revenue for total personnel expenses in municipalities.

However, even so, municipalities have committed a large part of their budget to paying public servants. During 2001-2012, municipalities committed, on average, 49% of their net current revenues to paying staff.

Thinking about this whole situation, the work empirically analyzed the influence of the mayor's re-election on the entity's fiscal sustainability.

Methodology Details

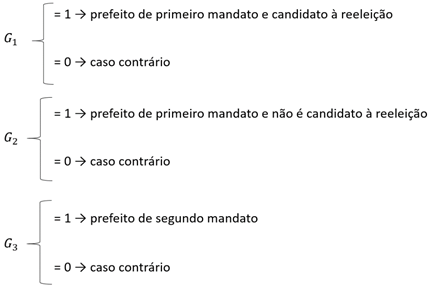

To analyze the possible impacts of reelection on municipal fiscal management, the authors used two models: (i) Classic Panel Data Models, for a set of 5,568 municipalities (2001-2012), and (ii) Differences in Differences, for 2,006 municipalities (2004-2008). For this analysis, the dependent variables were the municipality's fiscal indicators and the coefficients of the variables that identify first-term mayors expected to be re-elected and those without expected re-election, as follows:

Thus, a statistical significance in or

means a different behavior of the first-term mayor compared to the second-term mayor.

Using data from the Superior Electoral Court (TSE), a set of control variables was constructed from a political point of view: party political alignment, legislative fragmentation, executive competitiveness indicator, popular participation and party ideology. A set of variables was also created for the personal characteristics of mayors: gender, education and age. And, finally, a set of control variables was created with the economic aspects of the municipalities: poverty rate, Gini index, illiteracy rate and population.

Results

The results using the panel data approach indicate that municipalities in which mayors are first-term mayors tend to have a positive effect on the primary result. In other words, a mayor who runs for re-election generates, on average, a primary surplus of 0.11% of the municipal Gross Domestic Product (GDP) greater than a second-term mayor. In which mayors in have a stronger effect than their peers in

, with 0.07% of municipal GDP. This result corroborates what was stated by Meneguin et al. (2005), who concluded that the mayor is more responsible for the municipality's fiscal policy when there is the possibility of re-election, given that he himself will have to bear the future burden of public debt.

Another result found is the fact that mayors present an increase of, on average, 0.059% in municipal GDP with public employee payroll and a reduction in spending on capital investments. This effect was also observed in the mayors of

, however, to a lesser extent.

The estimates for the Differences in Differences model suggest that the expectation of re-election has a positive effect on the primary surplus of municipalities. In which, they indicate that the effect is much stronger in municipalities with greater fiscal sustainability.

Public Policy Lessons

Empirical evidence demonstrates that the expectation of municipal re-election has a positive influence on aspects of fiscal policy, that is, indicating that mayors in their first term with expectations of re-election present a more sustainable fiscal policy. Thus, attention is drawn to the potential harmful effects of the end of reelection on subnational fiscal policy.

Reference

MARCINIUK, Fernanda L.; BUGARIN, Maurício S. The influence of reelection on subnational fiscal policies. Brazilian Journal of Economics, v. 73, p. 181-210, 2019.