Responsible researcher: Eduarda Miller de Figueiredo

Article title: PUBLIC SERVICING AND INCOME INEQUALITY IN BRAZIL

Article authors: Francine Martinez Braite and Vladimir K. Teles

Location of intervention: Brazil

Sample size: 27 states (1986-2011)

Sector: Economic Policy & Governance

Type of intervention: Wages and income inequality

Variable of main interest: Gini Index

Assessment method: Others

Policy Problem

Inequality in Brazil has been decreasing since the 1990s, with an acceleration in reduction since the 2000s, however, it continues to be one of the countries in the world with the greatest income inequality. This reduction is a consequence of changes made in the structure of society through the increase in the proportion of adults equaling the per capita within the same group, government transfer programs, education level, reduction in discrimination based on race and gender, among others ( Barros et al., 2006).

Differences in income obtained between the private and public sectors may imply differences in inequality indicators, as salaries received by public servants are higher when compared to salaries in the private sector. Furthermore, the public sector is of significant size, where salary rules do not follow market standards.

When analyzing the case of inequality in Brazil, Hoffmann (2006) introduced several important variables for the country's context, some of them being government transfers and the amount paid in pensions and retirement benefits. In his findings, he observed that government transfers play a relevant role in reducing inequality, unlike the amount paid in pensions and pensions, which act towards increasing inequality.

Assessment Context

To analyze income inequality in Brazil, it is necessary to study the history of the Brazilian economy. In the 1970s, the Brazilian economy experienced intense economic growth that was affected by the oil crisis that devastated the entire world at the end of the decade. Between 1980 and 1990, the country faced political instability resulting from the end of the dictatorship and hyperinflation. Then, the Plano Real in 1994 provided the stabilization that granted a period of more sustainable growth that lasted until the first decade of the 2000s.

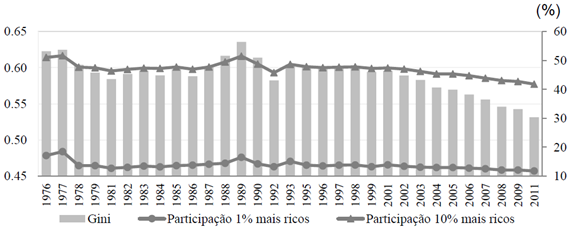

Figure 1: Evolution of income distribution in Brazil

From the graph presented in Figure 1, it was observed that the Gini index [1] and the participation indicators of 1% and 10% of the richest in income fell in the 1980s, but in the final years of the decade they increased again, lasting at high levels until the beginning of the 90s. The situation changed after the Real Plan, when inequality rates began to reduce, however, even with this reduction, income inequality in Brazil still has high levels in relation to the rest of the world

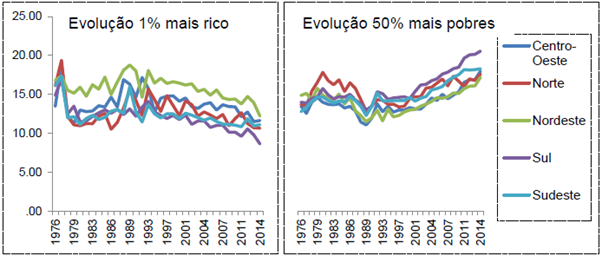

In the late 1970s and early 1980s, the disparity between the degree of income concentration between the richest 1% and the poorest 50% became evident. In which the portion appropriated by the richest in this period was greater than or equal to that appropriated by the poorest for practically all of Brazil, with the biggest difference being in 1977 for the Central-West region. Just like the inequality indicators, from the mid-nineties onwards, the situation improved, with the South region in 2014 reaching the lowest level of appropriation by the richest 1%.

According to a study carried out by the IMF (2015), in the period between 1990 and 2012 there was an increase in income inequality in developed countries with an increase in income at the top of the distribution, contrary to what occurred in Brazil. In countries with emerging economies, the study found a greater absorption of income by the portion of the population with lower incomes.

Policy Details

To analyze which factors contributed to the fall in income inequality in the period from 1991 to 2011, the authors used control variables such as education, unemployment rates, size of the State, proportion of poor people in the economy and government social programs. These variables were added to the model as they impact income inequality.

A model was used with dynamic panel data, called System-GMM , in which the lagged dependent variable (Gini index) was included as an explanatory factor in the model. To do this, they used five time periods for the 27 Brazilian states: 1986-1991, 1991-1996, 1996-2001, 2001-2006 and 2006-2011.

Although there are a number of studies on income inequality in Brazil, few studies focus on the differences in income obtained between the public and private sectors and the consequences of this difference in inequality indicators. To this end, the article set out to understand this possible relationship through a new dependent variable, the public sector Gini index. The main motivation for studying this distinction between sectors is the fact that public sector salaries are higher in relation to the private sector, in which there was a 35% increase for public sector employees between 1992 and 2005, in comparison to just 4% of the private sector.

Results

The results found by the authors demonstrate that economic growth has a negative impact on the Gini index for the period analyzed. However, they found that the variable that indicates the average years of study of individuals over 25 years of age played an important role in reducing income inequality in Brazil. Through the variable that contained the measure of the proportion of government transfers [2] in relation to the State's GDP, the importance of government social policies in reducing inequality in the period was verified.

When interacting the percentage of the population living below the poverty line with economic growth, the authors observed that, although economic growth generates effects on reducing inequality, the greater the proportion of poor people in the economy, the lower the impact of economic growth. in reducing income inequality. Therefore, when the proportion of poor people reached 55%, the impact of growth would become null.

When the public sector Gini index was used as a dependent variable, the results differed, demonstrating that government transfers possibly benefited a part of the population that is not included in the civil service class and, therefore, is not relevant to reducing income. inequality for the sector. The private sector Gini index demonstrated that the acceleration of economic growth has an impact on job offers, increasing wages and reducing inequality.

When measuring whether impacts are permanent or temporary, it was assumed that the Gini index would stabilize in the long term and assume a constant value. The education variable presented results that demonstrate that it has permanent effects in reducing the Gini indicator, suggesting the importance of education as a responsible factor for reducing income inequality in Brazil in the long term. In relation to government social programs, the results show that the programs were important for reducing inequality during the study period, but have a reduced reach in the long term.

Public Policy Lessons

The study demonstrates that in the Brazilian case, economic growth and education were fundamental to income inequality in the short term, referring to the period studied, as well as in the long term. Furthermore, the importance of the proportion of population below the poverty line is noted, since the higher the proportion, the less effective economic growth will be and the consequent reduction in income inequality.

Reference

BRAITE, Francine Martinez et al. Public service and income inequality in Brazil. 2018.

[1] The Gini Index is an instrument to measure the degree of income concentration in a given group, pointing out the difference between the incomes of the poorest and the richest.

[2] Continuous Payment and Social Assistance Benefit, Lifetime Monthly Income and Bolsa Família.