Responsible researcher: Adriano Valladão Pires Ribeiro

Article title: INEQUALITY AND GROWTH: WHAT CAN THE DATA SAY?

Article authors: Abhijit V. Banerjee and Esther Duflo

Location of intervention: Country panel

Sample size: 226 observations

Major theme: Economic Policy and Governance

Variable of main interest: Growth

Evaluation method: Kernel density estimation

Policy Problem

The relationship between social inequality and economic growth, despite being easily stated, is difficult to measure. The question is basically whether greater (or lesser) inequality is associated with greater or lesser economic growth. First, it is difficult to determine causality between this relationship. Second, comparing the particularities of each country creates problems, as isolated characteristics would affect both inequality and growth. Third, assuming the wrong form for the relationship can lead to distorted conclusions. The study presented below seeks to solve the last problem mentioned.

Assessment Context

In the economic literature, several studies have attempted to estimate the relationship between inequality and growth. The standard procedure assumes a linear relationship between the two objects, this implies that changes in one variable would always be associated with changes in the same proportion in the other. Furthermore, the technique used to estimate the relationship also matters, the result obtained can be negative, positive or none, that is, depending on the procedure, it can be thought that greater inequality would be related to lower, higher or no future economic growth. . Finally, it is not possible to speak of causality in the results obtained.

Intervention Details

In the theoretical field, there are two classes of arguments about the causal relationship between inequality and growth. Firstly, within the scope of political economy, the argument is based on the premise that inequality leads to the redistribution of wealth and redistribution negatively affects growth. The second is about a wealth effect, it is assumed that there is a relationship between wealth in the present and wealth in the future.

Exposing the thinking of political economy in a simple way, we have two political groups competing for the wealth of a country. At each period of time, a new opportunity for growth appears, but this opportunity would require structural changes and could be blocked by one of the groups. On the other hand, instead of blocking it, this group could accept the change by transferring part of the other group's wealth. The time that passes until the groups reach an agreement reduces the potential for growth and the final share of wealth of each group will measure the level of inequality. Thus, not only are inequality and growth strictly linked, but changes in inequality have causal effects on growth.

The wealth effect argument is based on the idea that each individual can spend or invest their wealth, growth would come from the decision to invest wealth. People with different levels of wealth would invest different amounts, thus creating a connection between inequality and growth. Some implications can be obtained from this thought: (i) after a certain wealth, individual investment would not change; (ii) increased wealth dispersion reduces the growth rate; (iii) inequality and growth tend to decrease over time. Therefore, growth would decrease with both an increase and a decrease in inequality, that is, observable changes in inequality imply a decrease in the growth rate.

Methodology Details

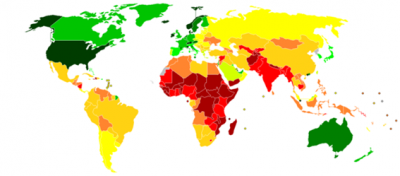

The data used to measure the relationship between inequality and growth are the Gini Index and the GDP growth rate. The Gini Index measures income concentration and varies between 0 and 1, where values close to zero represent greater equality and values close to one represent greater inequality. There would be several ways to capture this relationship, the 5 ways below are obtained from the discussion of the two arguments made in the previous section, with a brief intuition for each of the ways. Due to the difficulty in obtaining actual causality, the main objective is to capture the non-linear effects between inequality and growth, thus, none of the specifications assume that the relationship is linear.

Form 1: GDP growth rate as a function of current GDP and past changes in inequality. It captures the idea that variations in inequality have causal effects on growth, in addition to allowing such effects to vary according to the level of wealth.

Form 2: variations in inequality as a function of GDP levels and past inequality. The relationship between inequality and growth above is assumed to be valid and it is noted that changes in inequality are caused by the level of inequality.

Form 3: the square of the change in inequality as a function of the level of past inequality. The important thing would not be the variation in inequality, as in the previous case, but the absolute value of the change, since changes upwards or downwards would imply lower growth.

Form 4: the growth rate as a function of GDP levels and inequality in the previous period. It attempts to directly measure the effect of the level of past inequality on economic growth.

Form 5: the growth rate as a function of GDP, inequality and change in inequality. Through the wealth effect, variations in inequality have causal effects on growth, just as in the first way. However, the current specification is more general, as it allows the effect to differ according to the level of inequality.

Results

From the study of ways to obtain the relationship in the previous section, some results stand out. First, changes in inequality are related to subsequent economic growth in a non-linear manner, the relationship is inverted-U. This means that variations in inequality in either direction, increase or reduction, are associated with lower growth and, the greater the variation in inequality, the greater the drop in growth. Second, the relationship between variation in inequality and past level of inequality has a strong negative correlation, whereas the square of variation and the level of past inequality is positive. This tells us that smaller variations in inequality are related to the highest and lowest levels of inequality, while greater variations are associated with around the 0.45 value of the Gini Index. Finally, the U-shaped relationship between growth and level of inequality appears to be a mirror of the relationship between variation in inequality and growth.

Public Policy Lessons

The main lesson is to limit misinterpretations about the relationship between inequality and growth. There is evidence that the relationship is non-linear, so variations in inequality could be associated with both an increase and a decrease in growth. Another point is that, due to the limitations in isolating the causal effects of inequality on growth, nothing can be said about greater or lesser inequality implying greater or lesser economic growth. Creating an account on the Sportingbet platform is simple, just locate the registration button on the top right side of the website and then fill in a list of data such as name, surname, date of birth, nationality, contact method, etc.

Reference

Banerjee, Abhijit V.; Duflo, Esther. "Inequality And Growth: What Can The Data Say?," Journal of Economic Growth, v8(3,Sep), 267-299. 2003